The Economic and Financial Crimes Commission (EFCC) has warned banks against fraudulent practices including making themselves available as instruments of fraud.

The Executive Chairman of the EFCC, Ola Olukoyede gave the warning on Friday, November 22, 2024 when the management team of Moniepoint, led by its founder and Group CEO, Tosin Eniolorunda paid a courtesy visit to the commission.

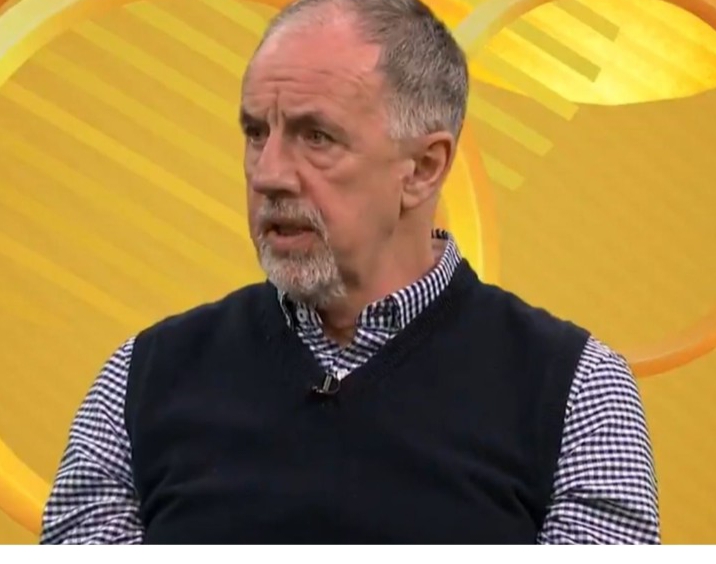

Olukoyede who spoke through his Chief of Staff, Commander of the EFCC, Michael Nzekwe noted that Nigerian banks over the years have become notorious as conduits of financial crimes.

Nzekwe advised that they should turn a new leaf for the sake of the growth of the country, saying: “There is hardly any financial crime that would not go through the financial institutions.

“Money laundering is a major issue and you find out also that the perpetrators go through the banks. Nigeria will be the greatest beneficiary when we do the right thing,” he said.

Addressing the Moniepoint delegation , he said: “Try as much as possible on your own to avoid any form of connivance and don’t be a channel for money laundering.

“Don’t be a tool, don’t make your system porous. You are a major stakeholder when it comes to the fight against corruption. We are open and would assist, however we can. No one is above the law.”

Olukoyede observed that there was a high level of poor internal control by fintechs at the level of the unbanked, the under-served and the middle class population spectrum.

“There’s quite a whole lot of fraud that goes around that particular level, so the issue of KYC (Know Your Customer) is very important, especially because of the issue of how fintechs open tier-one accounts, sometimes without attention to KYC,” he said.

“And people take advantage of this and are quick to commit fraud through this negligence. So, that’s one area you have to also look at to see how you can improve on your KYC.

“Increasing your level of collaboration with the EFCC would mean to see yourselves as stakeholders in the fight against corruption.

“We would like you to be able to respond to us when we make inquiries and when we make requests.”

Speaking further on the readiness of the Commission to collaborate with Moniepoint to get things right, Olukoyede said: “On our part, we are open to whatever it is that you want us to do.

“We value it that you are here today to seek a stronger tie and collaboration. When we have stakeholders come in and want to be part of what we are doing, majorly stakeholders like you, it gives us joy because we know that no one man can fight corruption alone.

“The collaboration you seek tells us that you want to strengthen your system; you want to be able to create more internal controls.

“You want to be able to put in place things that will mitigate those weaknesses that will lead to fraud within your system, that’s what we do.

“Our core mandate is enforcement and investigation of economic and financial crimes. So, we’re glad and wish to collaborate with you.”

Earlier in his remarks, Eniolorunda noted that the expansion in the operations and services of the fintech and microfinance company have come with challenges which have made the need for a strategic collaboration with the EFCC compelling.

“Moniepoint has over the years grown to become one of Nigeria’s largest payment service providers and the bank for mostly mid-class businesses and the under-served.

“Today, Moniepoint processes roughly 70% of Nigeria’s payments on Point-of-Sale (PoS) and transfers.

“We are present also in the U.K and we are going through some potential set-up also in Kenya, which is at an advanced stage with its Central Bank. And also in Tanzania.

“Of course, with all this growth comes also challenges. One of the biggest challenges is the nature of our country, where if people find the opportunity to make fast money, they will make fast money.

“And we have realized that as Moniepoint is helping people make ends meet, these sorts of people are also trying to use Moniepoint channels to achieve their criminal objectives.

“So, we are actively fighting, improving all the necessary KYC accounts, money laundering and fund protection systems, but we know that we can’t do this alone.

“There are experts in a government organization like the EFCC that we believe we need to have a strategic relationship with to be able to fight these people together.

“There are intels that you see that we don’t see. There are many things that come across your desk, every day that we don’t see.

“There are also things that we see that we think that if we should show to you, we will all be able to come together and fight these bad guys.

“We have, over the years improved on many things; discover a lot of potential fraud, collaborated with law enforcement agencies.

“With our whole management team, we will be able to find a strategic partnership with the EFCC that would take us to the next level.

“So we need to quickly build stronger alliances to prevent any form of risks that will blossom into national security issue,” he said.

Football17 hours ago

Football17 hours ago

News22 hours ago

News22 hours ago

Entertainment23 hours ago

Entertainment23 hours ago

Business23 hours ago

Business23 hours ago

News20 hours ago

News20 hours ago

News21 hours ago

News21 hours ago

News23 hours ago

News23 hours ago

National23 hours ago

National23 hours ago

News20 hours ago

News20 hours ago

News20 hours ago

News20 hours ago