News

I almost joined Chelsea in 2014 – Lionel Messi

News

EPL:Tottenham Humiliate Manchester City with Stunning 4-0 Victory in Premier League Clash

News

FIBA Africa gives more responsibilities to the Zones

News

FIBA Africa gives more responsibilities to the Zones…Confirms host of Afrobasket men and women events…Madagascar’s Jean Michel appointed as Vice

News

NFF President, Gusau, elected 1st Vice President of WAFU B

News

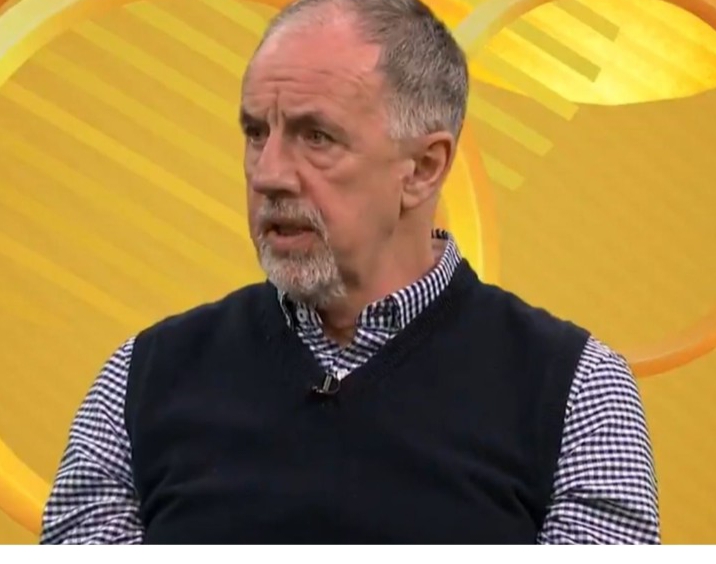

Mark Lawrenson Predicts Premier League Results for the Weekend Fixtures

News

Nigeria’s Super Falcons Drawn Against Tunisia, Algeria, and Botswana in Group B of 2024 WAFCON

-

News15 hours ago

News15 hours agoNigeria’s Super Falcons Drawn Against Tunisia, Algeria, and Botswana in Group B of 2024 WAFCON

-

News15 hours ago

News15 hours agoNFF President, Gusau, elected 1st Vice President of WAFU B

-

News16 hours ago

News16 hours agoEFCC warns banks against fraudulent practices

-

News16 hours ago

News16 hours agoAgain, Naira gains massively against the US Dollars

-

Metro5 hours ago

Metro5 hours agoYobe approves N70,000 minimum wage for workers

-

Education15 hours ago

Education15 hours agoJigawa sponsors 30 Engineering graduates to China

-

News8 hours ago

News8 hours agoFIBA Africa gives more responsibilities to the Zones…Confirms host of Afrobasket men and women events…Madagascar’s Jean Michel appointed as Vice

-

News2 hours ago

News2 hours agoEPL:Tottenham Humiliate Manchester City with Stunning 4-0 Victory in Premier League Clash

-

News5 hours ago

News5 hours agoFIBA Africa gives more responsibilities to the Zones

-

Metro13 hours ago

Metro13 hours agoNigeria sharia police to raid betting shops after court ruling