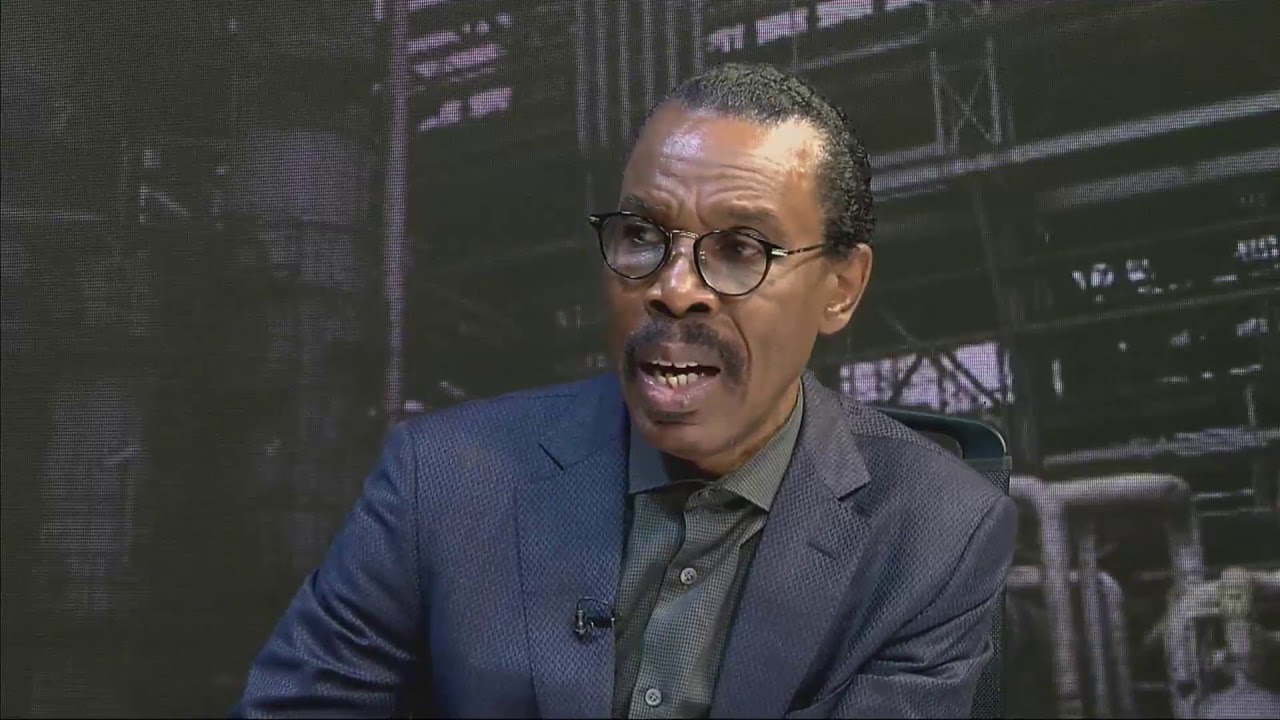

Bismarck Rewane, the Managing Director and CEO of Financial Derivatives Company Limited, has forecasted that Nigeria’s economy will expand by 3.5 percent by 2026, bringing the nation’s gross domestic product close to $400 billion.

He shared this information during the Access Bank Customer Forum held in Lagos on Thursday.

“The Nigerian economy will grow at 3.5 per cent (approximately $400bn). Nigeria is on track to becoming the second-largest economy in sub-Saharan Africa,” Rewane said.

He mentioned that the nation’s foreign exchange auction system would improve in efficiency, with unrestricted foreign reserves expected to hit $20 billion.

“There will be an efficient forex auction system, and unencumbered foreign reserves will hit $20bn,” he noted.

Rewane forecasted that inflation would fall to 22 percent by 2026, anticipating a yearly decrease in the monetary policy rate to 20 percent. This reduction is expected to result in a drop in the amount of non-performing loans within the banking sector.

“We will see inflation drop to 22 per cent, and the MPR is likely to come down to 20 per cent, which will reduce bad loans,” he explained.

Even with these encouraging developments, Rewane cautioned that the naira is expected to exchange at N1,550 per dollar in the black market, highlighting intervention funds, remittances from abroad, and exchange rate regulations as crucial elements influencing the currency’s value.

Rewane attributed these enhancements to intervention funds, remittances from the diaspora, and policies aimed at adjusting the exchange rate.

“These gains are driven by intervention funds, remittances, and adjustments to exchange rate policies,” he noted.

He stated that total factor productivity is projected to grow to 2.6 percent by 2026, an increase from 2.4 percent in 2024, and that the nation’s trade balance is anticipated to reach $9.3 billion, up from $8.42 billion.

“Total factor productivity will increase to 2.6 per cent, and our trade balance will grow to $9.3bn,” he stated.

Rewane forecasted that petrol prices would settle at N900 per litre, supported by a reliable supply ensured by production from the Dangote refinery and modular refineries.

“We expect petrol to stabilise at N900 per litre due to increased production from Dangote refinery and modular refineries,” he said.

Here’s a paraphrase of your sentences:

He also estimated that the stock market capitalization could increase to N58 trillion, following the inclusion of major companies like Dangote Refinery and the Nigerian National Petroleum Corporation.

Regarding commodity prices, Rewane forecasted that a crate of tomatoes would be priced at N20,000, a bag of rice would cost N75,000, and a bag of beans would hit N110,000 by 2026.

The head of FDC highlighted that inflation continues to be a significant obstacle for Nigerian businesses, impacting their profit margins.

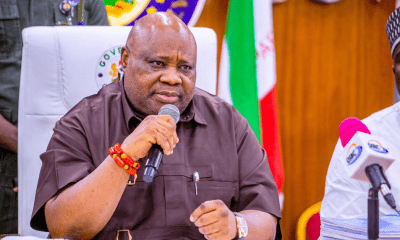

Additionally, the Minister of Finance and Coordinating Minister of the Economy mentioned that Nigeria’s foreign reserves have experienced a net inflow of approximately $2.35 billion into the Central Bank.

“There has been a net inflow in the first seven months of this year of about $2.35bn every month,” Edun stated, adding that the increase had played a key role in stabilising the naira in the forex market.

“We also have foreign exchange liquidity. The gross reserves are up,” the minister continued.

He attributed the growth to the government’s efforts, saying, “On the fiscal side as well, government revenues are growing.”

Edun emphasized that the country’s tax-to-GDP ratio was at 10%, with revenue to GDP at 15%, and urged increased investment in infrastructure and social safety nets to improve these low figures.

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, voiced concerns about the current economic outlook, comparing it to the more optimistic projections made by Bismarck Rewane.

“Our projection is slow, and I do not pray that Bismarck’s projection comes to pass,” Oyedele said.

He emphasized the challenges of divestment, inadequate education, and increasing unemployment, pointing out that the Nigerian currency had depreciated in value by ten times more than the Kenyan shilling.

He emphasized the importance of making decisions based on data.

“We must leverage data and evidence to ensure it serves our interests,” he stated.

Oyedele mentioned that the Federal Government aims to lower corporate income tax in the upcoming years. He also noted that the government seeks to lessen the tax burden on businesses while focusing on improving collection efficiency to boost revenue.

News17 hours ago

News17 hours ago

Education23 hours ago

Education23 hours ago

News22 hours ago

News22 hours ago

Metro23 hours ago

Metro23 hours ago

News14 hours ago

News14 hours ago

National20 hours ago

National20 hours ago

News17 hours ago

News17 hours ago

News16 hours ago

News16 hours ago

Entertainment13 hours ago

Entertainment13 hours ago

Business14 hours ago

Business14 hours ago