Business

Naira depreciates by 1.92% against dollar at official market

Business

1 out of 4 Nigerians want to migrate-NBS

Business

FG, World Bank to provide jobs for 10 million youths in 5 years

Business

Dangote Refinery Launches Fuel Export to West Africa

Business

Naira depreciates again by 2.3% against dollar at official market

Business

CBN to Nigerians: Beware of fraudulent contracts, project funding claims

Business

Nigeria will be in trouble if states collect VAT – Tinubu’s tax team

-

News22 hours ago

News22 hours agoEfe Ajagba Poised to Challenge Daniel Dubois for IBF Heavyweight Title

-

News18 hours ago

News18 hours agoSimon Ekpa to be extradited to Nigeria – Defence

-

News21 hours ago

News21 hours agoFederal High Court Adjourns Labour Party’s Suit on Rivers Lawmakers’ Defection to January 2025

-

News20 hours ago

News20 hours agoHP Wolf Security Launches Advanced Physical Cyberattack Protection for Business Introducing HP Enterprise Security

-

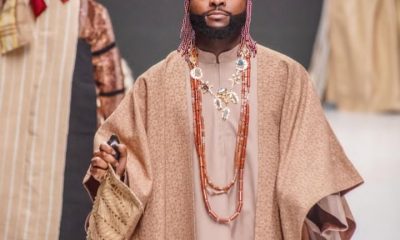

Entertainment17 hours ago

Entertainment17 hours agoDavido Reflects on Life as He Turns 32: “My Eyes Don See Shege”

-

Business18 hours ago

Business18 hours agoFG, World Bank to provide jobs for 10 million youths in 5 years

-

News5 hours ago

News5 hours agoNEC sets up National Electrification Committee to end grid collapse

-

Entertainment6 hours ago

Entertainment6 hours ago12 Secret Santa Gifts That Could Get You Fired

-

Entertainment17 hours ago

Entertainment17 hours agoAfrican Music Takes Over Coachella 2025: Seun Kuti, Remain and More to Perform

-

News7 hours ago

News7 hours agoNFF holds match commissioners’ seminar in Asaba