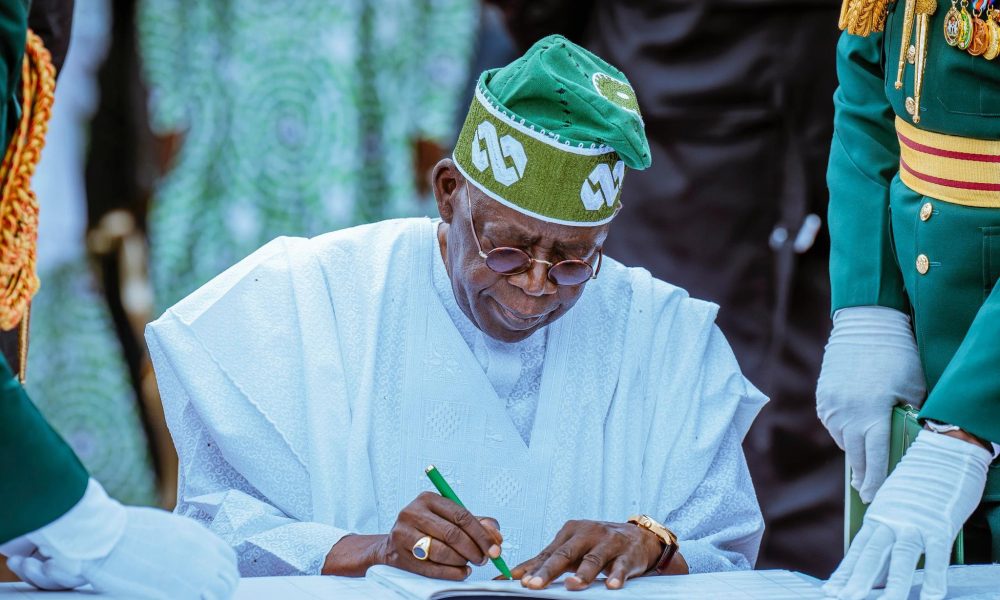

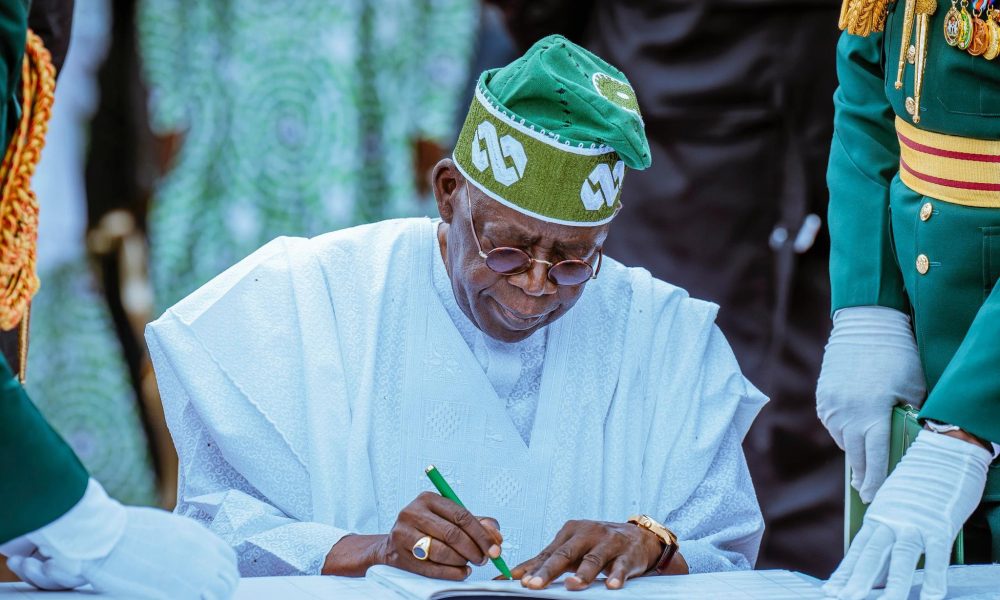

President Bola Tinubu has submitted four tax reform bills to the House of Representatives (Reps) for swift approval.

According to a post on the PBAT Media X account, Tinubu submitted the groundbreaking tax reform bills to the House of Reps on Thursday.

“President Bola Tinubu is shaking things up in Nigeria’s tax administration. He has just submitted four groundbreaking tax reform bills to the House of Representatives for swift approval,” the statement read.

“These bills are designed to propel the country’s economic growth and streamline its fiscal institutions.”

The four tax reform bills include the Nigeria Tax Bill 2024: This bill will provide the much-needed fiscal framework for taxation in Nigeria, outlining the rules of the game for tax collection and administration.

Also on the list is the Tax Administration Bill: Get ready for a clearer and more concise tax legal framework as this bill aims to reduce disputes and make tax administration a breeze.

Another one is the Nigeria Revenue Service Establishment Bill: Time to bid farewell to the Federal Inland Revenue Service (FIRS) Act. This bill will establish the Nigeria Revenue Service, modernizing tax collection and management.

Finally, there is the Joint Revenue Board Establishment Bill: This bill will create a tax tribunal and a tax ombudsman, ensuring fairness and transparency in tax disputes.

According to the statement, these reforms are crucial for Nigeria’s economic development as they will strengthen fiscal institutions, promote economic growth and align with the government’s objectives.

“With these bills, President Tinubu is sending a strong message: Nigeria is open for business and committed to fiscal responsibility,” the PBAT Media said.

“The Presidential Committee on Fiscal Policy and Tax Reforms has already submitted its report to President Tinubu, outlining the roadmap for these reforms.

“And as part of the holistic fiscal policy reform, the Federal Government (FG) has gazetted the Deduction of Tax at Source (Withholding Tax) Regulations 2024, offering relief to manufacturers and businesses. Exciting times ahead for Nigeria’s economy!”

free temp mail

October 3, 2024 at 12:17 pm

very informative articles or reviews at this time.