News

10 most frequently asked questions about tax reform bills

The Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele has come up with the 10 most frequently asked questions about the tax reform bills.

Oyedele in a post on his official X account on Monday afternoon said it is not unusual for a major reform such as this to elicit keen interest from all stakeholders.

He said this development is necessary to achieve the best outcomes that benefits all as it provides an opportunity for further engagements which is healthy for the system.

“In this regard, we have collated the most frequently asked questions about the tax reform bills to better inform all stakeholders and address some misleading analyses in circulation,” Oyedele said.

Question 1

What is the whole fiscal and tax reforms all about?

Answer 1

Nigeria’s tax system has over time become complex, stifling growth and unable to generate the required revenue for development. This is largely due to lack of policy clarity and inconsistency, obsolete and ambiguous tax laws, weak and fragmented revenue administration.

The main objectives of the reform is to redesign the system to support growth by addressing current challenges such as multiplicity of taxes, ambiguous and obsolete provisions, reduce the tax burden on individuals and businesses while promoting the ease of doing business to facilitate sustainable economic growth and deliver shared prosperity for Nigerians.

The key targets include single digit number of taxes, harmonised and efficient revenue administration, increase in tax to GDP ratio, economic competitiveness, and removal of tax burden on the poor.

Question 2

How representative or inclusive was the process leading up to the various proposals?

Answer 2

The committee comprised over 80 individuals from all walks of life across the 6 geopolitical zones of Nigeria representing more than 20 government institutions, the organised private sector, trade associations, professional bodies, professional services firms, and the civil society. The composition ensures there is adequate gender balance, with people of different faiths and the youth. About 45 students were selected from 22 universities across Nigeria who support the secretariat work, conduct research and participate in committee meetings on a rotational basis.

Tailored sessions were conducted for more than 40 sectors representing over 90% of the economy and focus group engagements for people with disabilities, youths, and Nigerians in the diaspora. The committee requested inputs from all stakeholders and received memoranda from people in all the 36 states and the FCT.

Furthermore, exposure consultation sessions were organised for CFOs with over 300 companies represented, journalists, public analysts, tax consultants, and business owners. We also had engagements with the Nigeria Governors’ Forum, the Federal Executive Council, National Economic Council, finance commissioners, the Joint Tax Board, among others.

Question 3

Why is the VAT proposal generating so much controversy? Are we trying to fix what is not broken?

Answer 3

The current VAT system is fractured. The major issues include:

(i) disputes over VAT administration between some states and the federal government resulting in some landmark judgements and pending court cases. This is compounded by the fact that VAT is not stated in the 1999 Constitution thereby creating a lacuna. Our analysis shows that a central collection system is more efficient and benefits all. Once the contentious issues have been resolved, then VAT can be properly included in the constitution. The current sharing formula of FG 15%, States 50% and LGs 35% is proposed to become FG 10%, States 55% and LGs 35%.

(ii) imposition of parallel consumption taxes in some states along with VAT which increases the tax burden on the people and contributes to multiple taxation. The reform seeks the discontinuation of all consumption taxes other than VAT.

(iii) basis of distribution – the current formula for sharing VAT among states is based on 20% derivation, 50% equality and 30% population. The tax reform proposes a different model of derivation which will attribute VAT to the place of supply and consumption rather than the current model which attributes VAT to the state where it is remitted thereby favouring states with companies headquarters. Further, derivation under the new model will account for 60% of VAT distribution for better equity and to discourage any state from seeking to administer VAT as a state tax, which will not only result in much lower revenue for all tiers of government but will impose a higher burden on businesses.

The proposed derivation model is contained under S.22(12) of the Nigeria Tax Administration Bill which states that “For the purpose of attribution, any return under this section shall provide details of derivation of taxable supplies by location …”

The controversy has arisen from the perception that the proposed formula would lead to lower revenue for some states. However, the 5% to be ceded by the FG can be set aside for equalisation transfers to cater for any shortfall to a state under the new model. This ensures that no state is worse off in the short term while significantly enhancing economic activities and revenue for all states in the medium to long term.

Watch the explainer here bit.ly/48LIVBN

Question 4

Are the bills also seeking to merge or scrap some agencies?

Answer 4

No. The bills are seeking to merge taxes and harmonise revenue administration. The system will leverage technology for integration which will ensure seamless revenue administration with greater efficiency and less burden for people and businesses. Government agencies will be able to focus on their primary mandates rather than being distracted with revenue targets. Agencies that are currently collecting taxes and levies other than regulatory fees will therefore be funded through the budgetary process.

Question 5

One of the reform targets is to double Nigeria’s tax to GDP ratio over the next few years. Are we to expect more taxes?

Answer 5

The plan is to reduce the overall tax burden, not increase it. By simplifying the tax system, harmonising taxes and addressing impediments to investments, the reforms will boost economic activities and therefore enhance revenue generation for all tiers of government. This will ensure that we can raise tax revenue without raising tax burden, through various strategies including removal of disincentives to business formalisation, use of technology and data for intelligence, tax simplification and enhanced administrative capacity. Beyond raising revenue, curbing tax evasion also ensures that there is a level playing field for all rather than implicitly penalising compliant taxpayers and rewarding evaders.

Question 6

How will the reforms benefit businesses, large and small?

Answer 6

Businesses have consistently cited tax issues such as multiplicity of taxes and complex tax compliance requirements as major impediments to investment and competitiveness. Addressing these issues will therefore facilitate economic growth and boost the country’s GDP.

Some of the proposals include reduction of corporate income tax rate from 30% to 25% over the next 2 years and elimination of earmarked taxes on companies to be replaced with a harmonised single levy at a reduced rate.

Others include elimination of minimum tax on loss-making companies and those with low margins, grant of input VAT credit to businesses on assets and services to reduce cost of investment, ability to pay taxes on foreign currency transactions in naira, WHT and VAT exemptions for small businesses and a higher threshold of N50m annual turnover for corporate income tax exemption. There will be an office of the tax ombudsman to check administrative excesses and protect vulnerable taxpayers. In addition, there tax incentives are being rationalised with clear rules to ensure certainty and provide a level playing field for all investors, while a new priority sector incentive regime will replace the current pioneer status scheme etc.

Question 7

Is it true that workers will pay more PAYE tax?

Answer 7

The current taxable income bands and rates were introduced in 2011. Due to the lack of review, the structure has resulted in “fiscal drag” where many low income earners have been pushed to the top bracket over time due to high inflation. Also, the system discourages formalisation given that the tax rate on companies is nearly double that of enterprises which also encourages arbitrage in many cases.

The proposal seeks to address these issues and simplify the system by eliminating various reliefs and allowances while adjusting the bands and rates to achieve an overall lower effective tax rate for workers. This will ensure that an individual with basic education should be able to file their tax returns without any assistance. There is a rent relief allowance to provide additional benefits for low income earners.

Individuals earning about N1.7m or less per month will pay lower PAYE tax while those earning the new minimum wage and slightly more will be fully exempted. These thresholds will result in about 98% of workers in the public and private sector paying lower taxes while the top 2% will pay slightly more in a progressive manner up to 25% for high networth individuals.

Question 8

Are there specific proposals for the ordinary Nigerian?

Answer 8

Yes. The lowest income earners accounting for about one-third of all workers will be fully exempted from tax while low and middle income earners will pay less. This is consistent with the policy philosophy of not taxing poverty. Also, self employed persons and entrepreneurs will enjoy tax exemptions available to individuals in formal employment.

The VAT reform includes a zero (0%) rate for food, education, health, and exemption for rent and public transportation. These items constitute an average of 82% of household consumption and nearly 100% for low income households which will ameliorate the rising cost of living for the masses.

In addition, there are proposed changes to the income tax laws to facilitate remote work opportunities for Nigerians in Nigeria within the global business process outsourcing. This will empower our youths to play a key role in the digital economy space.

Question 9

We have seen different recommendations and proposals in the past. What will be different this time around?

Answer 9

The Presidential Fiscal Policy and Tax Reforms Committee was set up with a broad mandate covering fiscal governance, revenue transformation and economic growth facilitation. In addition, the committee is charged with implementation rather than merely submitting a report of recommendations at the end of its assignment which has a much lower chance of success. The various proposals were co-created with inputs from Nigerians, using data and evidence to inform the recommendations.

There are measures to ensure that the reforms are institutionalised via legal framework and administrative structures including systems to curb corruption and block loopholes through technology, self service and tax agents regulation as well as planned amnesty and whistleblowing framework to sanitise the system.

Question 10

What else is being done beyond the new tax bills?

Answer 10

There are various proposals which have been implemented or are at different stages of implementation including the 2024 WHT Regulations, Executive Orders, and the 2024 National Fiscal Policy with clear principles for fair taxation, responsible borrowing and sustainable spending including frameworks for subsidy and cash transfers, ESG and Sustainable Development Goals.

According to Oyedele, more information can be found on the committee’s social media accounts, fiscalreformsng on X, LinkedIn, Instagram, Facebook, YouTube channel and website, fiscalreforms.ng.

“You can also reach us via email at enquiries@fiscalreforms.ng or via WhatsApp chat on +234 810 975 3151,” he concluded.

You may like

-

Oyedele alleges FG has nothing to show for 60 taxes, levies collected

-

VAT boosts October revenue as FG, states, LGs share N1.411t

-

Zulum launches summit to reform Almajiri education in Borno

-

13 things to know about tax reform bills – Sunday Dare

-

Proposed tax reform bills not against north, says presidency

-

99% of wealthy Nigerians evade taxes as millions go hungry—Report

-

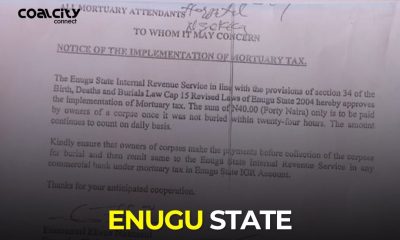

Enugu to tax corpses in mortuaries

-

Man laments excessive FIRS charges in Ekiti

-

FG to implement new withholding tax regulations in January

News

Ruud van Nistelrooy Opens Up on Hurtful Manchester United Exit Before Taking Leicester City Job

New Leicester City manager, Ruud van Nistelrooy, has shed light on his departure from Manchester United, expressing feelings of disappointment and hurt over how his exit unfolded.

The Dutchman, who stepped in as United’s interim manager after Erik ten Hag was sacked, has revealed he held an open and candid discussion with United’s new boss, Ruben Amorim, before his departure last month.

Van Nistelrooy explained that taking on the interim role was motivated by his deep connection with the club, its people, and its fans.

However, once Amorim arrived, the Portuguese manager opted not to include Van Nistelrooy in his coaching setup, a decision that left the former United striker disheartened.

“I stepped in as interim manager because I wanted to help the club during a difficult period,” Van Nistelrooy said.

“My intention was clear—I was there to assist United, and I was open to staying on in any capacity to continue that support.

So, when I was informed that I wouldn’t be part of the new coaching team, it was a tough pill to swallow.

I was disappointed, very much so, and it hurts.

”He added, “United is a club that means so much to me, and the bond I share with the fans and the people there is something I hold dear.

The only assistant managerial role I would have considered at this stage in my career was at United.

That’s why it stung even more to be shown the door.

”Despite his disappointment, Van Nistelrooy acknowledged the complexities of the situation, admitting that as a manager himself, he could understand Amorim’s perspective. “When I reflected on it, I got my head around the decision.

I understand that a new manager would want his own setup and might see my presence as a potential complication. It’s part of the job, and I respect that.

”Van Nistelrooy credited his conversation with Amorim for helping him move on. “I spoke to Ruben about it, man to man, manager to manager.

He was honest and respectful, and I’m grateful for that. It really helped me process everything and turn my focus to new opportunities.

”Shortly after his departure, Van Nistelrooy began discussions with Leicester City and was eventually appointed as their new manager.

The move, he said, has rejuvenated his spirits. “While leaving United hurt, the chance to take charge at Leicester City is an exciting new chapter for me, and I’m fully committed to making the most of it.

”As Van Nistelrooy transitions into his role at Leicester, his departure from United underscores the challenges even the most beloved figures face in football’s ever-evolving landscape.

News

Obasanjo would have died under Abacha if not for me -Gowon

Former Head of State, General Yakubu Gowon has narrated how former President Olusegun Obasanjo could have been killed for an alleged coup plot in 1995 under Gen. Sani Abacha if not for him.

Gowon said this at the maiden edition of the Interdenominational Unity Christmas Carol and Praise Festival organised by the Plateau Government.

The News Agency of Nigeria reports that Obasanjo was arrested in 1995 by General Sani Abacha and convicted of being part of a planned coup to overthrow his government.

Obasanjo, despite pleading innocent to the coup, was sentenced to death.

He spent three years in prison before he was released in 1998 following the death of Gen. Abacha on June 8 of that year.

While Gowon was the Special Guest of Honour at the event, Obasanjo was the Guest of Honour, respectively.

“I wrote a letter to Abacha, I pleaded with him that God made him a leader to do good and not evil.

“I sent my wife with the letter in the middle of the night to Abacha in Abuja; I pleaded with him that such a thing should not happen.

“I’m glad that soon after that, things changed, and not only that Obasanjo left prison, he became our president in 1999.

“This is something that only prayers and sincerity can do; I’m happy that today myself and Obasanjo are here to celebrate the unity of Plateau,” he said.

Gowon also thanked the state government for organising the carol, adding that it would further unite the citizens of the state.

The former head of state said that the state had gone through a myriad of security challenges. Hence, the carol provided a suitable avenue for the people to commune.

News

Why I don’t trust any public institution in Nigeria – Fisayo Soyombo

The founder of the Foundation for Investigative Journalism (FIJ), Fisayo Soyombo has revealed why he doesn’t trust any public institution in Nigeria.

Soyombo revealed this on Saturday during an interview on Arise Television, following his arrest and detention by the Nigerian Army for three days in Port Harcourt, Rivers State before he was released on Friday.

The investigative journalist explained that everything he told the army during interrogation was leaked to suspected oil thieves who also told him the exact things he said.

“How can you grill me at the 6 division and everything I told you, the illegal bunkerers were telling me. Every single thing,” he said.

“The real grouse of the army is that one, I did not carry them along. I would not deny that I have low trust for Nigerian public institutions.”

The FIJ founder added he does not trust any public institution in Nigeria dur to his ordeal investigating stories as an undercover journalist.

“A small two-minute diversion. Last year, I did an undercover investigation on an orphanage selling babies. I bought a new born baby for N2 million. I took the baby to NAPTIP, I looked after that baby,” he said.

“After I handed over the baby to NAPTIP, I sent a representative to go there every month. Her birthday, we bought a gift, Christmas same. We woke up one day and NAPTIP shut the door on us.”

The Nigerian Army had confirmed the arrest of the investigative journalist at an illegal oil bunkering site in the Niger Delta region.

The arrest, which sparked widespread concern and condemnation, occurred during an operation against oil theft and pipeline vandalism.

The confirmation followed public outcry over Soyombo’s detention, with the FIJ reporting on X (formerly Twitter) that Soyombo had been in Army custody for three days.

News

Minimum Wage: Cross Rivers Workers to embark on indefinite strike

The organized labor unions in Cross River State have announced plans to embark on an industrial action due to the state government’s failure to implement the newly approved minimum wage of ₦70,000.

This decision was confirmed by the Chairman of the Trade Union Congress (TUC) in the state, Mr. Monday Ogbodum, on Saturday in Calabar.

According to Ogbodum, the Nigeria Labour Congress (NLC) has set a deadline for the strike to commence at midnight on Sunday if the state government fails to meet their demands.

Speaking on behalf of the labor unions, he emphasized that there would be no backing down on the industrial action unless the government promptly implements the new wage structure.

“Yes, we are still in talks with the government,” Ogbodum said. “We had a meeting on Thursday, followed by another on Friday that stretched into the late evening. Another meeting is scheduled for today (Saturday).

However, this does not mean that all is well. While the government has shown some seriousness in addressing our concerns, our position remains clear: even if we sign any document or agreement today, it does not equate to actual implementation.

“The TUC chairman further explained that negotiations are ongoing, but the unions are prepared to join the strike should the need arise.

He stressed that labor unions are seeking tangible actions and not just verbal commitments.

Labor unions in Cross River State, including the NLC and the TUC, have expressed their dissatisfaction over the prolonged delay in adopting the new minimum wage policy.

The ₦70,000 wage adjustment was introduced to provide relief for workers amidst rising inflation and economic challenges.

Despite the federal government’s endorsement of the policy, some states, including Cross River, have been slow to implement it, citing financial constraints.

Union leaders argue that the state government has had ample time to prepare for the policy’s implementation and should prioritize the welfare of its workers.

They have warned that any further delay will be met with decisive action, as workers are no longer willing to endure the economic hardships caused by inadequate wages.

The situation remains tense, with stakeholders closely monitoring the outcome of the ongoing discussions between labor representatives and the state government.

The unions have called on the government to act swiftly to prevent the strike, which could disrupt essential services across the state.

News

Bayer Leverkusen Forward Victor Boniface Faces Possible Sanction for Reckless Driving Incident

Bayer Leverkusen forward, Victor Boniface, has landed himself in hot water following allegations of reckless driving and mobile phone usage on a highway in Germany.

The Nigeria international reportedly posted a photo on social media that showed him scrolling through his phone while driving his Mercedes-Benz.

The 23-year-old’s actions have sparked widespread criticism, with fans and commentators expressing disappointment at what they described as irresponsible behavior.

The incident has not only drawn public backlash but has also caught the attention of his club, Bayer Leverkusen.

Manager Xabi Alonso has expressed his disapproval of the forward’s conduct, hinting at potential disciplinary action. Speaking to BeIN Sports, the former Real Madrid and Liverpool star did not mince words regarding Boniface’s behavior.

“I don’t like it; it’s obviously not good, and of course, it’s not allowed to happen,” Alonso stated firmly.

“I haven’t seen Boni [Boniface] yet, but he knows it’s not allowed. We have to tell him he’s not allowed to do something like this.

”The coach’s remarks reflect the club’s commitment to maintaining high standards of discipline and professionalism among its players.

Such actions, particularly those involving risky driving behavior, not only tarnish the image of the player but could also bring unwanted negative attention to the club.Boniface’s alleged use of his mobile phone while driving breaches both German traffic laws and the moral expectations placed on public figures like professional footballers.

In Germany, it is illegal to use a handheld device while driving, with violators facing fines and potential driving bans.

Additionally, as a role model to young fans worldwide, Boniface’s actions could set a harmful precedent if not addressed appropriately.Since joining Bayer Leverkusen, Boniface has been a key figure for the club, earning plaudits for his performances on the pitch.

However, this off-the-field controversy threatens to overshadow his accomplishments. Fans have taken to social media to express their concerns, with many urging the young striker to prioritize safety and uphold the values expected of a professional athlete.As the club investigates the incident, it remains to be seen what disciplinary measures will be taken.

For now, the focus is on ensuring that the message is clear: such behavior is unacceptable. The situation serves as a stark reminder of the responsibilities that come with fame and the importance of setting a positive example, both on and off the field.

News

PH refinery has not commenced bulk sales – NNPC

The Port Harcourt Refining Company (PHRC) has not yet commenced bulk sales or opened its purchase portal, as essential processes are still being finalised.

The Nigerian National Petroleum Company Limited (NNPC Ltd.) says an official announcements will be made if and when price reviews on the products occur.

Mr Olufemi Soneye, Chief Corporate Communications Officer, NNPC Ltd. in a statement on Friday, said currently its products being sold were originated from the Dangote Refinery.

The 60,000 barrels per day (bpd) capacity refinery began truck-out of petroleum products on Tuesday in Port Harcourt following its rehabilitation.

Some petroleum marketers and Nigerians have raised operational concern about the refinery as regards to pricing.

The Petroleum Products Retail Outlet Owners Association of Nigeria (PETROAN) also confirmed that the Refinery had not released any new price for products purchase.

The association said that it bought PMS with the old pricing template while awaiting the new prices.

“Currently, the products we are selling originate from the Dangote Refinery and include applicable Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) fees,” he said.

“Products from PHRC are exclusively for our retail stores at this stage. Our pricing is reviewed and adjusted periodically as necessary to reflect operational realities.

“We advise the public to disregard any misleading information regarding pricing. Official announcements will be made if and when price reviews occur,”.

2025: How To Plan A Budget For The Upcoming Year

Ruud van Nistelrooy Opens Up on Hurtful Manchester United Exit Before Taking Leicester City Job

Obasanjo would have died under Abacha if not for me -Gowon

Why I don’t trust any public institution in Nigeria – Fisayo Soyombo

Minimum Wage: Cross Rivers Workers to embark on indefinite strike

Bayer Leverkusen Forward Victor Boniface Faces Possible Sanction for Reckless Driving Incident

Radda approves N70,000 minimum wage for Katsina workers

PH refinery has not commenced bulk sales – NNPC

CBN issues Dec. 1, ultimatum against banks, ATM delays