The Nigerian Education Loan Fund (NELFUND) has allayed fears that students would be harassed if they default in repaying the Federal Government Students’ loan.

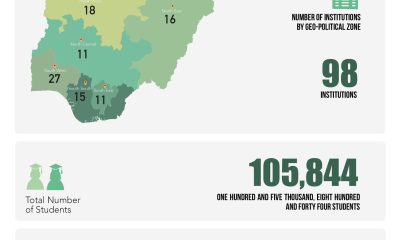

This comes as 260 federal and state tertiary institutions have been onboarded on the platform, with over 360,000 students registered on the scheme.

Speaking at a sensitisation meeting with students of the Ebonyi State University (EBSU), Abakaliki, on Thursday, Managing Director of the Fund, Akintunde Sawyerr, explained that while the facility is interest-free, students can only start repaying the loan two years after the National Youth Service Corp (NYSC) and working.

According to him, the Establishment Act has provisions for applicants to notify the agency if they remain unemployed after two years.

He said: “You will start loan repayment two years of graduation and completion of NYSC. Please also note that you cannot be reached for repayment of the loan if you are not working yet. So, don’t deny yourself the opportunity to get an education because of funds.”

The Guardian reports that the sensitisation for the student loan was organised alongside the leadership of the National Association of Nigerian Students (NANS) led by its President, Lucky Emonefe.

The Managing Director said the engagement was designed to expose the students to the huge benefits of loans, and the good intentions of President Bola Tinubu.

He highlighted the processes of applying for the loan, insisting that NELFUND made them simple and seamless, with less human interaction so that no one can be denied the opportunity of accessing the loan for education.

He informed the students that in addition to the tuition fees paid fully per cent to the institutions, students are given monthly stipends for upkeep.

NANS President, Lucky Emonefe, encouraged students to embrace the opportunity.

He assured them of the genuineness of the system, adding that it is not for a few privileged people as erroneously believed by many people, but for all students who indicated interest and submitted the necessary information to the portal.

Also, he Senior Special Assistant to the President on Community Engagement (South East), Chioma Nweze, said the sensitisation meeting became necessary following the poor interest of the students in the South East schools to access the loan.

She said: “We shouldn’t be lagging in things like this. This loan is available for all Nigerian students to assess irrespective of region, religion, political affiliation, or other differences, and if people from other regions are already enjoying the services, why should we be holding back? It’s important we leverage this opportunity to support our education.”

Also, EBSU Vice Chancellor, Prof. Chigozie Ogbu, highlighted some of the challenges they encountered in the cause of the application, even as he appealed to the Fund to address the issues to enable seamless application.

He, however, assured NELFund that the school management would continue to enlighten the students on the benefits of the student loan with guidance for seamless application.

“We have done this sensitisation in the past, and we saw the positive response we received from the students. The presence of senior NELFund and NANS officials in this engagement with students will further strengthen the confidence and trust of the students to the credibility and genuineness of the process,” he said.

Meanwhile, checks on the agency’s website revealed that as of October 3, 2024, 260 federal and state tertiary institutions have been onboarded on the platform, with over 360,000 student registrations and 267,984 loan applications.

Over 45,440 students have benefitted from the programme so far.

NELFUND announced that the first phase of the interest-free student loan which commenced on May 24, 2024, is expected to benefit no fewer than 1.2 million students.