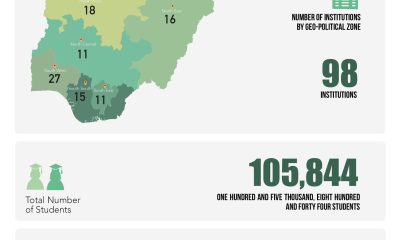

Nigeria has the highest representation, with 41 universities ranked, up from 37 last year, according to the Times Higher Education (THE) Sub-Saharan Africa (SSA) University Rankings 2024, which were released today.

The 2024 Rankings show that Nigeria has more than double the number of ranked institutions of any other SSA country, with its highest-ranked university being the American University of Nigeria at number 12.

Nigeria is also the most represented country at the top of the table, with 13 universities in the elite top 50, followed by South Africa with eight and Ghana with seven.

In all, 15 of the ranked SSA countries have at least one institution in the top 50.

Nigeria boasts the highest number of newly ranked institutions with 15 debutants, followed by Kenya with 10 new additions.

For overall representation, Kenya has the second highest number of institutions ranked with 15 and Ghana follows with 11. Somalia and South Africa each have 10 universities on the table.

The SSA University Rankings 2024 are calculated using five pillars, with each pillar made up of several metrics given varying weightings.

The pillars are: resources and finance; access and fairness; student engagement; ethical leadership; and Africa impact.

Nigeria outperforms the rest of SSA in the Africa impact pillar, with an average score of 49.8 – the SSA average is 48.4. This is mostly down to its success in the pan-African citations metric.

With regards to the other four pillars, Nigeria has lower average scores than the SSA average, however, it does lead the ethical leadership pillar with Landmark University, which boasts an impressive score of 96.8.

Despite below-SSA average scores for four pillars, Nigeria still manages relatively high scores in ethical leadership, 68.8, and in student engagement, 62 (SSA average is 62.5).

In the second edition of the rankings, the University of Johannesburg has jumped forward one place to take the number one spot. South Africa holds all three top places.

The University of Pretoria is in second place (up from fourth), and former number one, the University of the Witwatersrand, is now in third place.

South Africa also holds tenth place with newcomer institution the University of KwaZulu-Natal.

At the top of the table, Somalia joins the top 10 with SIMAD University in seventh place. Rwanda boasts the best newcomer, with the University of Rwanda going straight into the top 10 in sixth place. Rwanda’s highest-ranked institution overall is UGHE—University of Global Health Equity—in fourth place, up from eighth.

Ghana has two universities in the top 10, the University of Ghana in fifth place up from 17, and Ashesi University in ninth position (no move).

Uganda also holds a top-10 spot with Makerere University in eighth position, down from five.

Five new countries join the rankings: Namibia, Burkina Faso, Côte d’Ivoire, Cape Verde and Eswatini. Namibia leads the newcomers, with the University of Namibia in joint 13th place. Côte d’Ivoire is represented by four institutions, while each of the other debutant countries has one institution ranked.

Phil Baty, THE’s chief global affairs officer, said: “The Sub-Saharan Africa University Rankings are different from other international rankings as they focus not on metrics developed with an eye on the global north’s leading institutions and the global north’s priorities, but on metrics that matter most to the development of nations south of the Sahara—including access and inclusion, economic growth, sustainability and African impact.

“Times Higher Education is proud to have developed this ranking in deep partnership with African institutions and organisations themselves to deliver a set of benchmarks with real, focused impact.”